Manhattan Life Assurance Things To Know Before You Buy

Wiki Article

Our Hearing Insurance For Seniors Diaries

Table of ContentsWhat Does Attained Age Vs Issue Age Mean?Unknown Facts About Hearing Insurance For SeniorsFacts About Boomerbenefits Com Reviews RevealedNot known Facts About Boomerbenefits.com ReviewsGetting My Boomerbenefits Com Reviews To Work

(by mail), even if they do not likewise get Medicaid. The card is the system for health and wellness care companies to bill the QMB program for the Medicare deductibles and also co-pays.

Hyperlinks to their webinars as well as various other resources goes to this link. Their info includes: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This write-up was authored by the Empire Justice.

Boomerbenefits Com Reviews for Dummies

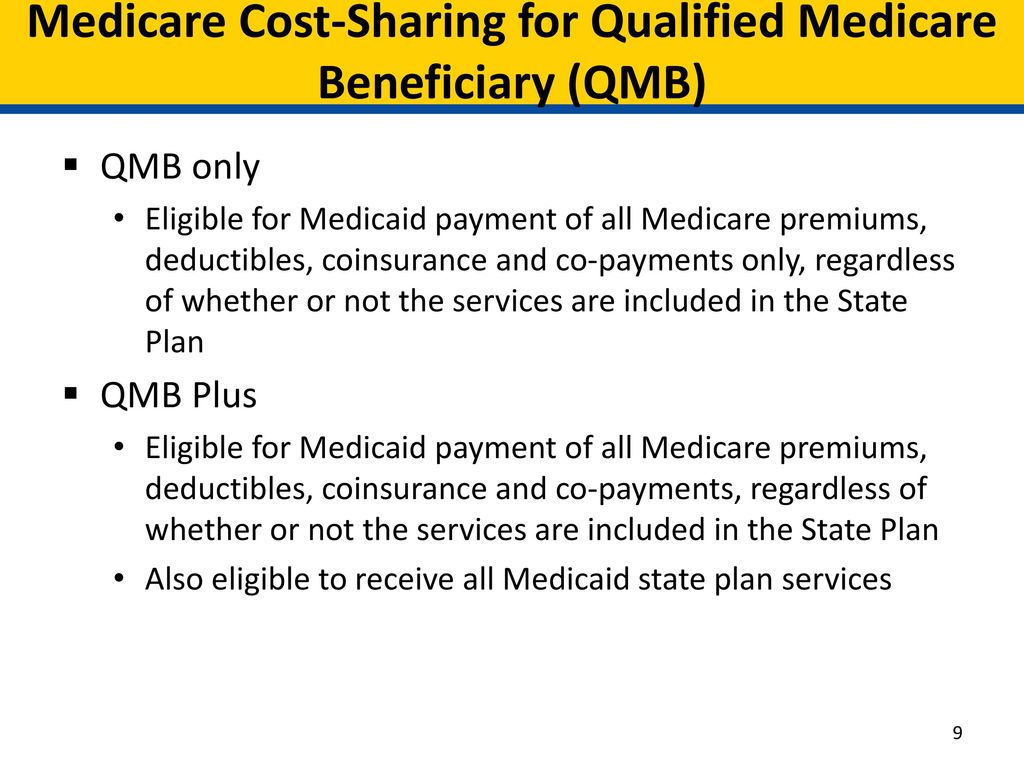

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Any person who gets approved for the QMB program does not have to pay for Medicare cost-sharing and also can't be billed by their wellness care carriers. If a person is considered a QMB And also, they meet all criteria for the QMB program however also fulfill all monetary requirements to obtain complete Medicaid services.

The very first step in enrollment for the QMB program is to locate out if you're eligible. You can ask for Medicaid to offer you with an application kind or locate a QMB program application from your state online.

There are instances in which states might limit the amount they pay health and wellness treatment providers for Medicare cost-sharing. Even if a state restricts the amount they'll pay a copyright, QMB members still do not need to pay Medicare companies for their healthcare costs and also it's against the regulation for a service provider to ask to pay - what is medicare part d and how does it work.

Usually, there is a costs for the strategy, however the Medicaid program will pay that costs. Lots of people pick this extra insurance coverage since it gives routine oral as well as vision care, and some come with a gym subscription.

The Buzz on Medigap Plan G

Select which Medicare plans you would like to compare in your area. Contrast rates side by side with plans & carriers offered in your location.He is included in many magazines along with composes on a regular basis for other skilled columns relating to Medicare.

Several states allow this throughout the year, but others limit when you can sign up partially A. Keep in mind, states use different rules to count your revenue and also properties to establish if you are eligible for an MSP. Instances of earnings include wages and also Social Protection advantages you receive. Instances of possessions include checking accounts and also stocks.

And some states do not have a possession restriction. If your income or assets appear to be above the MSP standards, you must still apply if you require read more the assistance. * Qualified Impaired Working Person (QDWI) is the fourth MSP and spends for the Medicare Part A costs. To be eligible for QDWI, you must: Be under age 65 Be functioning yet continue to have a disabling impairment Have minimal earnings and properties And also, not already be eligible for Medicaid.

The Ultimate Guide To Plan G Medicare

20 for each brand-name medicine that is covered. Extra Help only applies to Medicare Part D.

MSPs, consisting of the QMB program, are provided via your state's Medicaid program. That suggests that your state will identify whether you qualify. Different states may have various methods to calculate your revenue as well as sources. Let's examine each of the QMB program qualification criteria in more detail listed below.

The monthly earnings limitation for the QMB program boosts each year. Source limits, In addition to a regular monthly earnings restriction, there is additionally a source restriction for the QMB program.

Our Aarp Medicare Supplement Plan F PDFs

Like earnings limitations, the resource restrictions for the QMB program are various depending upon whether or not you're wed. For 2021, the resource limits for the QMB program are: $7,970 $11,960 Source limitations also increase every year. Similar to revenue limitations, you must still get the QMB program if your sources have a little enhanced.Report this wiki page